Congestion on the ethereum cryptocurrency network has hit record levels, driving per-transaction fees into three figures and rendering many decentralised finance (‘DeFi’) projects unviable.

“Just spent $100+ on ETH gas fees to send a token.” Changpeng Zhao, chief executive of cryptocurrency exchange Binance, wrote on Twitter earlier today.

‘Gas’ is the fee required to successfully conduct a transaction on ethereum, paid in the cryptocurrency’s native currency, ether.

“Waiting forever to convert some of my ERC-20 tokens due to these fees. I’ve written off so many projects because they are on the ethereum network and I hate dealing with the gas fees during congestion,” another cryptocurrency user tweeted.

ERC-20 is the technical standard for the so-called ‘smart contracts’ that run on ethereum, a cryptocurrency network designed to allow the automated execution of financial transactions.

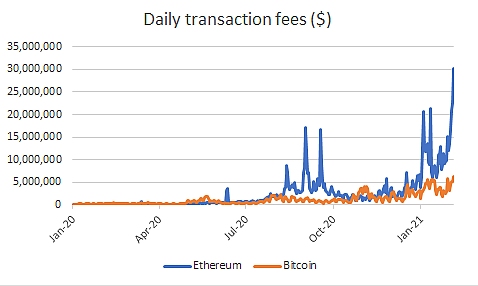

According to data provider Coinmetrics, aggregate transaction fees on ethereum hit a record $34m on February 5, up nearly 600 percent since the beginning of the year.

Ethereum transaction fees also now dwarf those on bitcoin, where fees yesterday added up to $5.5m.

The price of ether, the native token on the ethereum network, also hit an all-time high of $1764 on February 5.

Source: Coinmetrics

The surging demand for ethereum transactions is being driven by a boom in DeFi projects, many of which use decentralised protocols to trade or lend their own ERC-20 tokens.

For example, Uniswap allows token holders to swap them for other cryptoassets, a process that incurs a transaction fee on the main ethereum network.

Another popular DeFi protocol, Aave, allows uncollateralised loans to be made and repaid within a single ethereum block, also incurring a transaction fee in ether.

Some market observers view the congestion levels on ethereum as detrimental to the network’s long-term prospects.

“Due to the limited capacity of the [ethereum] network, the current transaction pricing mechanisms are prioritising those investors that send the highest-value trades,” Anish Mohammed and Tarun Wadhwa wrote recently in a guest post on New Money Review.

“In other words, participation is being limited to those with large amounts of capital, leaving small-time traders behind. As new investors get priced out, adoption stalls, and eventually promising ideas languish because of this distortion. Over time, this type of situation can lead to ruin,” said Mohammed and Wadhwa.

Others believe that ethereum can cope with the rising demand from cryptocurrency users by shifting much of its current transaction activity to so-called second layer networks.

“Many smaller users and use cases are currently priced out from using ethereum,” Hasu, a cryptocurrency analyst, told New Money Review earlier today.

“This creates activation energy for wallets, projects and users to adopt Layer 2 solutions,” said Hasu.

“Several are production ready or close to it, so it’s very healthy in that sense.”

Amidst the ongoing cryptocurrency boom, programmers are researching a number of different technical solutions to expand the practical capacity of the ethereum network.

Several of these Layer 2 scaling solutions promise transaction throughput capacity of 20,000 transactions per second or more. By comparison, the main ethereum network currently handles a maximum of 30 transactions per second.

Another potential solution to ethereum’s capacity constraints is the upgrade of the whole network to ETH 2.0, a proposed change that involves switching ethereum’s consensus mechanism from proof-of-work to proof-of-stake.

Proof-of-work, the consensus mechanism that also underlies bitcoin, relies on miners—the computers validating transactions on the network—proving they have expended a certain amount of electrical energy.

In proof-of-stake, a largely untested consensus mechanism, miners are replaced by stakers or validators—entities who hold coins and who seek to maximize the value of their stake.

Sign up here for the New Money Review newsletter

Click here for a full list of episodes of the New Money Review podcast: the future of money in 30 minutes

Related content from New Money Review