In 2008, a few obscure three-letter financial products—MBS, ABS, CDOs and SIVs—set off the biggest financial crisis in history.

Now, could a new alphabet soup of DAOs, NFTs, Dapps, DMMs and DEXes pose similar risks to financial stability?

Yes, says Hilary Allen, our guest on the latest New Money Review podcast. Allen is a professor at the American University Washington College of Law, where she teaches financial regulation.

Hilary Allen

The latest acronyms—for decentralised autonomous organisations (DAOs), non-fungible tokens (NFTs), decentralised applications, market makers and exchanges (Dapps, DMMs and DEXes)—all come from the decentralised finance (“DeFi”) market.

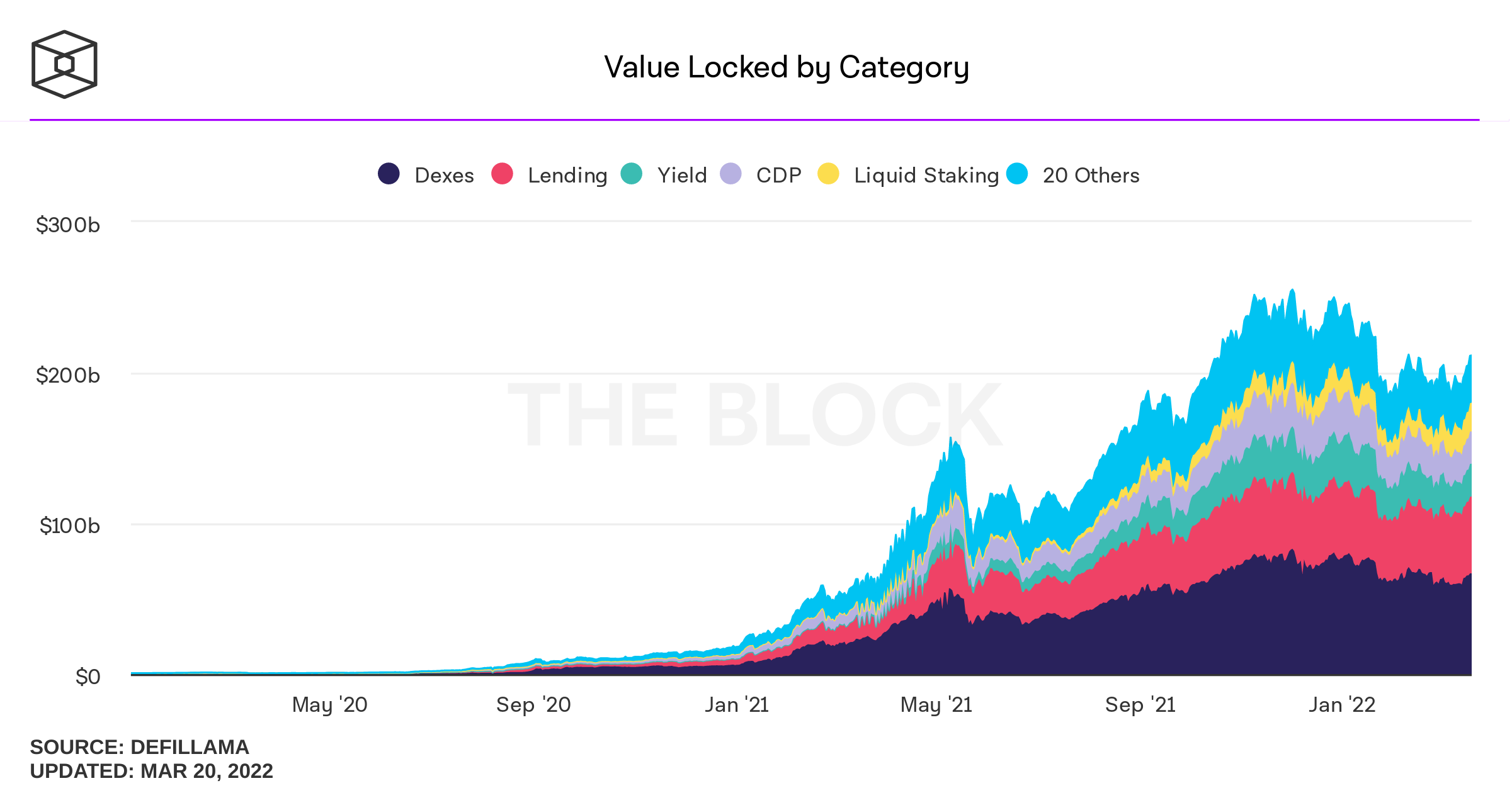

DeFi is a $210bn market of financial services built on top of cryptocurrency networks like ethereum.

Total value locked in DeFi applications

DeFi activities parallel those undertaken in the traditional financial system, such as trading, lending and investing—but without banks, central trading platforms or investment firms.

“What has really struck me the most is how quickly we forget”

The sector includes a number of automated lending protocols, such as Aave, bZx v2, Compound, Maker, Polygon Aave and Venus. It also contains automated market making protocols, such as Uniswap, Curve, and Balancer, and automated investment vehicles, such as Yearn and Convex.

But according to Allen, DeFi increasingly resembles the ‘shadow banking’ sector that triggered the 2008 meltdown—and very few people are paying attention.

Allen says that three key risks in DeFi—heightened leverage, rigidity, and the potential for investor runs—are the same as those that grew out of control fifteen years ago.

“What has really struck me the most,” Allen says in the podcast, “is how quickly we forget.”

Listen to the podcast to hear more.

Sign up here for the New Money Review newsletter

Click here for a full list of episodes of the New Money Review podcast: the future of money in 30 minutes

Related content from New Money Review

Unstable DeFi could trigger wider crash

Hedge fund/crypto cocktail could be lethal