Why is the price of bitcoin for future settlement above the current (‘spot’) price? How are hedge funds trying to arbitrage differences in cryptocurrency funding rates? Why is the largest closed-end bitcoin fund trading at a discount during a bull market? And what’s the relationship between this discount and the interest rates on retail bitcoin deposits?

In this Q&A, Max Boonen, director and founder at cryptocurrency market maker B2C2, throws light on these and other intricacies of the bitcoin financing market.

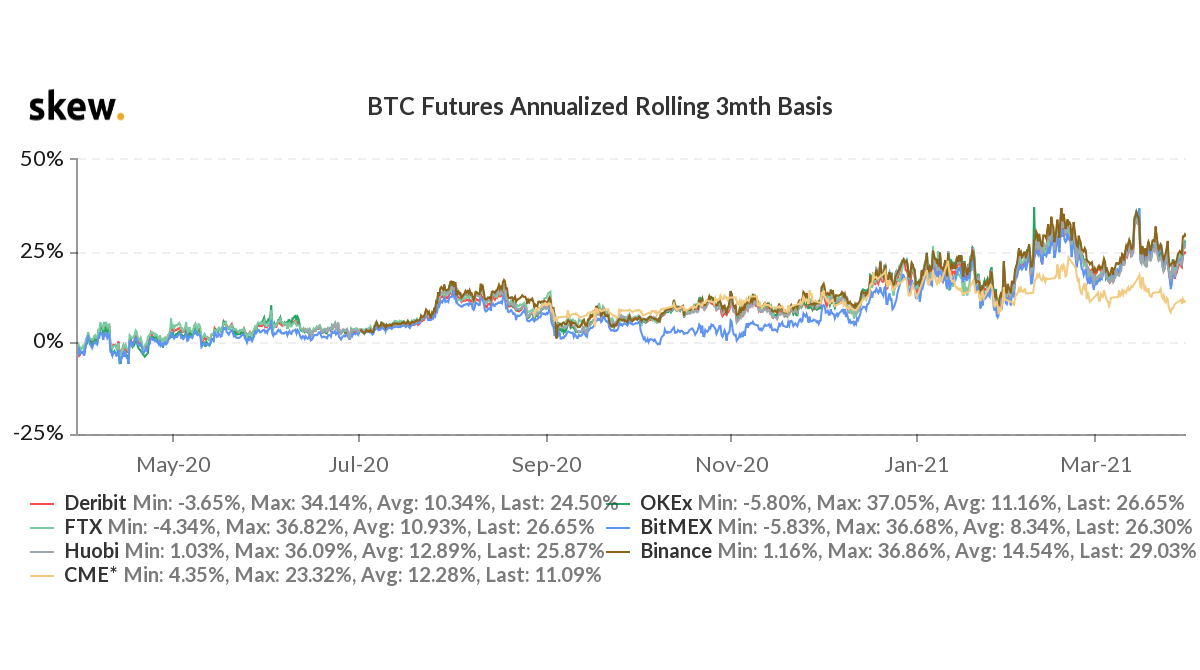

New Money Review: In bitcoin, futures prices are currently trading some way above spot prices, in what is often referred to as a ‘positive basis’, ‘premium’ or ‘contango’. What is causing this?

Max Boonen: This phenomenon has been around for a while and, first and foremost, it reflects the speculative interest in bitcoin. When everyone thinks cryptocurrency prices are going up, buying futures is a way to express a bullish view without having to put down too much money.

The bitcoin futures premium reflects speculative interest

It’s worth remembering that a year ago, the reverse was the case and futures were trading at a discount to the bitcoin spot price.

Bitcoin futures basis is around +25 percent per annum

NMR: What arbitrage opportunities does the current contango create?

MB: In a perfect market, bitcoin futures would differ from spot prices by the exact difference in interest rates between bitcoin and US dollars. Right now, you can borrow dollars, buy bitcoin, sell the future and make a risk-free profit. It’s a really attractive trade. But there are not so many traders with the means and the set-up to do it. If someone came along with $20bn to try and exploit the current arbitrage, the premium would collapse.

NMR: What’s the relationship between the listed futures on bitcoin and the perpetual bitcoin swaps that were popularised by exchanges like BitMEX?

MB: The relationship reflects the difference between short-term and longer-term crypto funding rates. The perpetual swap is a short-term instrument, since it offers traders margined exposure to the bitcoin spot rate. It can be seen as an ‘overnight’ future. The implied funding rate in the perpetual swap is a lot more volatile than the implied interest rate in the term futures.

There are arbitrage opportunities here too. For example, the implied funding rate on the bitcoin swap might be 70 percent, while the implied rate on the future might be 20 percent. So you could sell the swap and buy the listed future. But in order to make money, you need to be collecting the 70 percent for long enough to offset the 20 percent you’re paying on the future.

This trade is less risky than taking an outright bet on the bitcoin price, but it’s definitely riskier than the first, ‘cash and carry’ arbitrage.

NMR: What about the basis risk in the first, simpler arbitrage? The future is cash-settled, so you can’t deliver the bitcoin you bought to close out the trade.

MB: You don’t have to wait and let your position expire against the futures benchmark—you can roll it before expiry. But a lot of people do wait for expiry, considering the basis risk to be pretty small: they could have earned 5 percent over the quarter from the arbitrage, so for them it doesn’t matter if there’s 10 basis points slippage against the futures benchmark.

Having said that, the most sophisticated players do manage that specific risk.

NMR: What other risks are there in the arbitrage?

MB: Most bitcoin futures are collateralised in bitcoin itself. This means you can place all the bitcoins you purchased onto the futures exchange as collateral, so you are fully funded in that sense. Clearly, this leads to another risk: if the exchange goes bust, you lose your entire principal. So you are replacing the liquidation risk in the futures trade with credit risk against the exchange.

If you use a bitcoin futures contract that is collateralised in dollars—like the CME contract—you are adding a level of complexity. If the bitcoin price goes up and you have sold the bitcoin future as part of your arbitrage trade, you need to deliver more dollars as collateral to the futures exchange’s clearing house. However, as part of the arbitrage trade, you own bitcoin. So you need to be able to lend your bitcoins against dollars in order to top up your margin.

For that reason, the bitcoin futures that are collateralised in bitcoin will not trade in the market at the same level as the futures that are collateralised in dollars. However, these differences are not material.

Most hedge funds are buying bitcoin spot and selling the future

NMR: What kinds of trades are hedge funds currently making in bitcoin?

MB: Most are doing the simple arbitrage—buying bitcoin spot and selling the future—although some are involved in the more complex arbitrage involving the funding rates in the future and the perpetual swap.

NMR: To what extent are these trades putting pressure on the spot bitcoin price? I’ve read articles saying they are contributing to a supply shortage, causing a squeeze in the price.

MB: 95 percent of the time, these trades have no impact on the bitcoin price. When they do, it’s because of liquidations. That happened in March 2020, for example, when the bitcoin price fell sharply. And, at the time, the bitcoin price on BitMEX—where a lot of leveraged traders held positions—moved to a sharp discount to the bitcoin price on other exchanges.

A liquidation event could take place in a bull market

But a similar liquidation event could take place in a bull market as well. For example, the bitcoin price could move up so sharply that a fund is unable to top up its collateral positions to support its short futures position and the fund gets liquidated by the futures exchange’s clearing house. The fund would probably then turn to the market and sell its spot bitcoin at the same time.

This could cause the futures basis to move from its current level of 20-25 percent to 30, 40 or even 50 percent. Meanwhile, the traders who would normally step in to bring the futures premium back down might not be able to do so because of their own position limits.

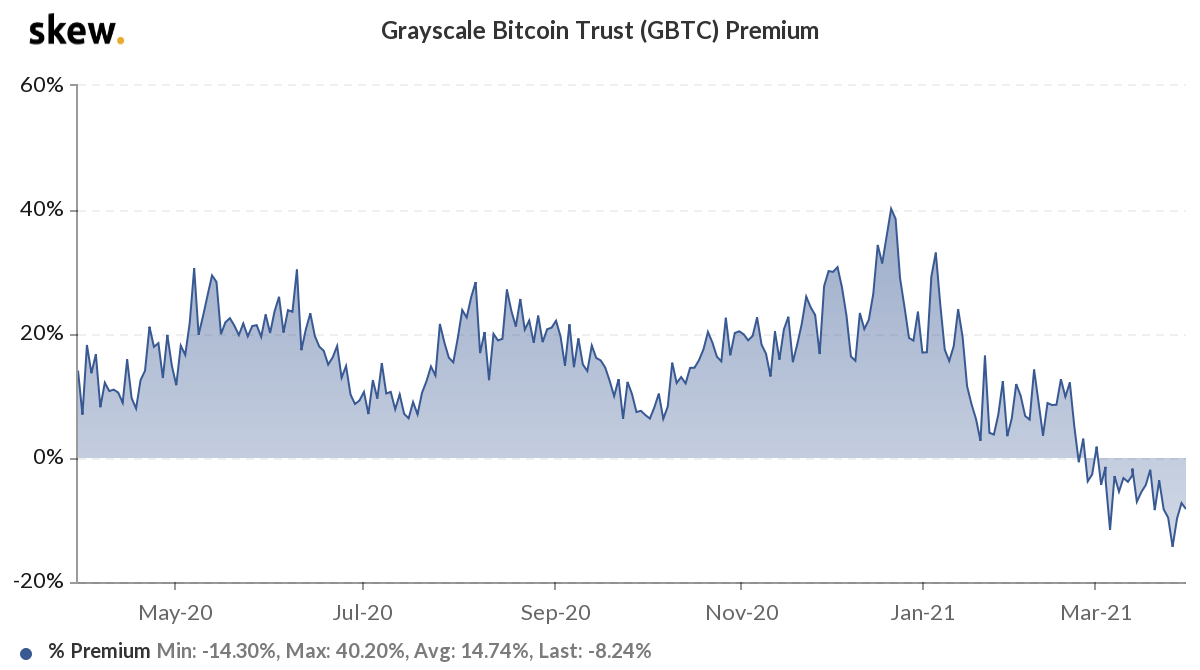

NMR: At the same time as we observe a contango in bitcoin futures, there’s now a discount in the Grayscale Bitcoin Trust (GBTC), which has been used in the past by a lot of institutions to gain access to bitcoin. What’s going on there?

Discount in Grayscale Bitcoin Trust

MB: Here, we’ve been seeing kind of the opposite trade to the futures arbitrage I’ve just described.

Firms like BlockFi, which offer interest on cryptocurrency deposits, were using the past premium on GBTC to help fund their business. They could borrow bitcoin from their clients (with or without collateral), put the bitcoin into GBTC, hold the GBTC shares for the six-month lock-up period, then sell them on the secondary market with a premium attached.

Now the premium has collapsed to a discount, making this trade uneconomical. What is unusual is that this has happened during a period when the bitcoin price has gone up. Normally you’d expect closed-end trusts like GBTC to rise to a premium during a bull market—mirroring what we’ve been seeing in the futures market.

The bitcoin bull market has put strain on business models like BlockFi’s

The reason for the collapse of the premium is that alternatives for investors have emerged in the form of new bitcoin ETFs. No-one needs to pay a premium any more to access bitcoin in a fund structure.

The bull market in bitcoin has put further strain on business models like BlockFi’s. If you borrow bitcoin when it’s $20k and suddenly it’s $50k, you have to top up your dollar collateral by a lot—assuming you are collateralising your clients’ deposits. The pain has been maximised both by the GBTC premium collapsing and the bitcoin price rising.

In the coming weeks, a lot of GBTC shares are coming out of lock-up. It will be interesting to see what happens there.

NMR: If a firm like BlockFi were to collapse, would it have systemic consequences for cryptocurrency?

MB: It wouldn’t be great, but I’m not sure it would be a disaster either. In cryptocurrency, we don’t yet have long daisy chains of credit exposures. The people with credit exposure to BlockFi are largely retail investors with relatively small positions. Institutions, as far as I’m aware, don’t have major exposure to this firm.

The main systemic risk in cryptocurrency is at the exchanges

NMR: Are there systemic risks elsewhere in crypto?

MB: The main systemic risk in cryptocurrency is to be found at the exchanges. All the institutions are touching the larger exchanges, leaving collateral with them and so on. So if an exchange got into trouble and halted withdrawals it would be a big deal. We were quite close to that in September last year when the founder of the OKEx crypto exchange was arrested and for two months the exchange didn’t process withdrawals. That was a big deal.

Sign up here for the New Money Review newsletter

Click here for a full list of episodes of the New Money Review podcast: the future of money in 30 minutes

Related content from New Money Review